.

Understanding the Cannabis Stock Market

Cannabis stocks have the potential to be very lucrative. However, they are volatile and unusually susceptible to legislative changes. Here we explore the nature of cannabis stocks, their pros and cons, and an overview of this burgeoning area.

Contents:

- What is the cannabis stock market?

- Factors influencing the cannabis stock market

- How to invest in cannabis stocks

- Pros and cons of investing in individual stocks vs etfs

- Risks and challenges in the cannabis stock market

- Top cannabis stocks and etfs to watch in 2025

- The future of the marijuana stock market

- Is it worth investing in cannabis stocks?

Key Points

- Legislation is potentially the single biggest factor affecting cannabis stocks.

- You can buy individual stocks or invest in ETFs.

- The cannabis stock market is highly volatile.

- Investing in cannabis carries the same challenges as all investments.

The cannabis industry has experienced rapid expansion in recent years, transforming from a niche sector into a significant market force. With increasing legalization efforts worldwide, the cannabis stock market is drawing attention from investors seeking new opportunities. But how does the cannabis stock market work, and what factors influence its growth?

This article provides a beginner-friendly overview of the cannabis stock market, key trends shaping the industry, and practical advice on how to invest in cannabis stocks wisely.

Note: We are not providing investment advice here. Rather, we are simply offering readers a basic overview of the topic.

What Is the Cannabis Stock Market?

The cannabis stock market is made up of all the publicly traded companies that operate within the cannabis sector and can be invested in (i.e. in which anyone can purchase shares).

Ranging from cultivators and distributors to pharmaceutical firms researching cannabis-based treatments, it’s a diverse and vibrant market made up of everything from companies focused on the nuts and bolts of growing to those conducting cutting-edge research into how cannabis can be used in a medical context. So whatever your interests, there’s probably something for you there.

Following legislative changes (often for the better) throughout the world, this market is gaining traction among both institutional and retail investors as cannabis-related stocks are, in general, becoming increasingly valuable. Not only this, but there are simply more and more cannabis companies appearing, creating something of a startup boom.

If there was ever a time to invest in cannabis, it’s now.

Types of Companies in the Cannabis Market

Let’s take a deeper look at the types of companies you’re likely to come across in the stock market:

- Cultivators and producers: Companies that grow and distribute cannabis for medical and recreational use.

- Retailers and dispensaries: Businesses selling marijuana products directly to consumers.

- Biotech and pharmaceutical firms: Companies developing cannabis-based medical treatments.

- Ancillary service providers: Firms supplying equipment, packaging, or financial services to the cannabis industry.

Factors Influencing the Cannabis Stock Market

Several factors influence the performance of marijuana stocks, affecting investment decisions and overall market trends. While these are similar for most stocks, cannabis is particularly susceptible to certain factors that most stocks aren’t as affected by (such as legal changes). So you should know that while the marijuana stock market is exciting, it’s also incredibly volatile and uncertain.

Legalization

Regulatory changes are a major driver of the cannabis stock market. In fact, they’re probably the most important factor. Countries and states that legalize marijuana often see increased investment and stock market activity in the sector.

In a globalized world, changes in one region can have a big impact elsewhere. For instance, the legalization of weed in Germany—Europe’s biggest economy—signaled a significant change in European attitudes towards cannabis and had global impacts.

Market Trends

Consumer demand plays a significant role in shaping cannabis stock valuations. Take the boom in wellness-related marijuana products from the last decade or so. Before then, nobody knew what CBD was, and now, practically everyone has heard of it. Given that consumer behavior dictates where the money will go, this is also a huge factor. If people want to buy certain products, then their value will increase.

Pharmaceutical stocks are also increasing as marijuana becomes more explored as a possible source of medicine. It’s long been touted as such, but the medical community is finally seriously investigating it, which also means that there’s serious investment in this sector—and it’s likely to pay dividends.

Finally, the continued (and growing) love of recreational weed massively influences investment considerations wherever recreational marijuana is legal, so don’t underestimate the influence of people’s old-fashioned love of getting high.

Economic Conditions

Like all industries, the marijuana stock market is influenced by wider economic factors, including investor sentiment and risk appetite, interest rates and access to capital for cannabis firms, and broader stock market trends and sector rotations.

The cannabis industry is just one part of the whole global economy, and thus is affected by the winds that affect all stocks.

How To Invest in Cannabis Stocks

For beginners, investing in marijuana stocks requires careful research and planning. Although it’s a volatile and relatively new sector, this also creates the possibility to strike gold. So if you’re willing to keep your head and accept risk, there is money to be made. Here’s a step-by-step guide for investing in weed stocks.

Step 1: Understanding Stock Exchanges and How to Find Cannabis Stocks

Marijuana stocks are listed on major exchanges such as the Nasdaq, New York Stock Exchange, London Stock Exchange, and Euronext. Some companies also trade on smaller exchanges or over-the-counter (OTC) markets.

You can also invest using the plethora of trading apps available these days. While these are best suited to novices, as they are simple to use and offer graded experiences, they also take higher commissions and come with other limitations. Still, for beginners, they are probably the best option.

Step 2: Research Companies and Evaluate Their Performance

You should never invest blind, and you should be wary of trusting your instincts. At its most ill-informed, investing is basically gambling, and even if you’re very well-informed, it’s still risky.

However, you can mitigate this risk by researching the companies before investing and also by taking a macro look at the entire marijuana industry, the economy as a whole, and the legal landscape. Even if one company appears to be doing well, it’s not going to be worth investing in if a recession is around the corner or the law is about to change in a way that’s prohibitive towards cannabis.

What’s more, you should also see which other companies are offering the same products or services as those you’re considering investing in, and how they are performing. If they’re floundering, why? Or, are they doing better than your company and likely to drown it out?

Before investing, analyze key metrics such as:

- Revenue growth and profitability

- Regulatory compliance and market positioning

- Recent news and strategic partnerships

Step 3: Diversifying Investments Within the Marijuana Sector

Diversification reduces risk. Investors can spread their funds across different cannabis sub-sectors. This is about the long game and spreading the net wide. Of course, you could put all of your eggs in one cart and hope for the best, but if it doesn’t work, then you’ll lose all your capital. If, however, you diversify, you can afford to make some mistakes but will still eventually see a return on your investment if even one pays off.

Diversify in the following sectors:

- Medical marijuana companies

- Recreational cannabis firms

- Ancillary businesses supporting the weed industry

Pros and Cons of Investing in Individual Stocks vs ETFs

You can invest in individual stocks or exchange-traded funds (ETFs). ETFs are investment funds that hold multiple underlying assets and can be bought and sold on an exchange, much like an individual stock. So basically, it diversifies for you.

Investing in Individual Cannabis Stocks

The pros of investing in individual cannabis stocks are:

| Potential for high returns if a company performs well | Greater control over investment choices | Ability to time the market | Exposure to emerging companies |

| Potential for high returns if a company performs well | Greater control over investment choices |

| Ability to time the market | Exposure to emerging companies |

The cons of investing in individual cannabis stocks are:

| Higher risk due to stock-specific volatility | Requires in-depth research and monitoring | Regulatory uncertainty | ELiquidity concerns |

| Higher risk due to stock-specific volatility | Requires in-depth research and monitoring |

| Regulatory uncertainty | Liquidity concerns |

Investing in Marijuana ETFs

The pros of investing in cannabis ETFs are:

| Diversification across multiple cannabis companies | Lower risk compared to investing in individual stocks | Managed by professionals with industry expertise |

| Easier for beginners | Exposure to both large and small cannabis companies | Potential for steady returns |

| Diversification across multiple cannabis companies | Lower risk compared to investing in individual stocks |

| Managed by professionals with industry expertise | Easier for beginners |

| Exposure to both large and small cannabis companies | Potential for steady returns |

| Limited control over specific stock selection | ETF management fees may reduce returns | Less opportunity for high gains |

| Performance depends on the fund manager's strategy | Regulatory risks still apply |

| Limited control over specific stock selection | ETF management fees may reduce returns |

| Less opportunity for high gains | Performance depends on the fund manager's strategy |

| Regulatory risks still apply |

Risks and Challenges in the Cannabis Stock Market

Like any investment, cannabis stocks come with risks, including:

- Regulatory uncertainty: Laws and regulations can change, impacting stock performance.

- High market volatility: Cannabis stocks can experience dramatic price swings.

- Ethical and environmental concerns: Investors may need to consider sustainability and ethical issues in cannabis cultivation.

In a politically unpredictable world, all investment is risky as it’s unclear where the global economy, or national economies, are headed. On top of that, it’s even more unclear where the pendulum will swing regarding cannabis regulation. In North America, where cannabis has been legalized for a longer time, it is more likely to remain that way. However, in Germany where legalization is only recent, it is far more likely that it could stall or even be reversed.

So the regulatory landscape is the biggest challenge facing those who wish to invest in cannabis.

Top Cannabis Stocks and ETFs to Watch in 2025

The market changes constantly, so use these suggestions as a starting point but make sure you do some further research too. That being said, here are some cannabis companies to watch in 2025.

Leading Cannabis Companies

Here are some of the leading cannabis companies for those who want to invest in individual stocks.

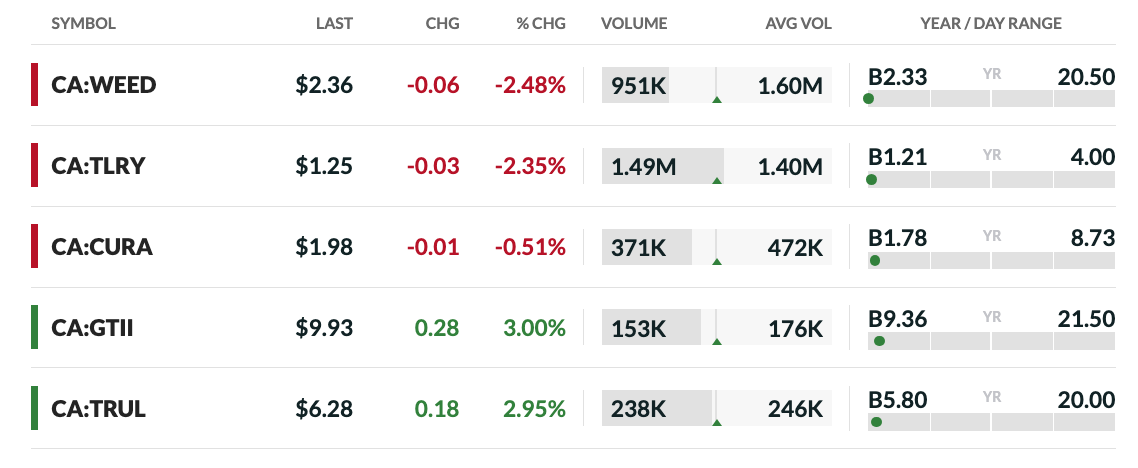

Canadian Cannabis Stocks

- Canopy Growth Corporation: As one of the pioneers in the cannabis sector, Canopy Growth has established a significant presence in both medical and recreational markets. The company has been focusing on restructuring efforts to achieve profitability.

- Tilray Brands Inc.: Tilray has expanded its global footprint through strategic mergers and acquisitions, aiming to strengthen its position in the international cannabis market.

US Cannabis Stocks

- Curaleaf Holdings Inc.: Curaleaf is a leading US cannabis operator with a broad network of dispensaries and cultivation sites across multiple states. The company continues to expand its product offerings and market reach.

- Green Thumb Industries Inc.: Green Thumb has demonstrated consistent growth with a focus on high-quality products and strategic retail locations. The company emphasizes operational efficiency and brand development.

- Trulieve Cannabis Corp.: Dominating the Florida market, Trulieve has a strong retail presence and continues to expand into other states, leveraging its vertically integrated operations.

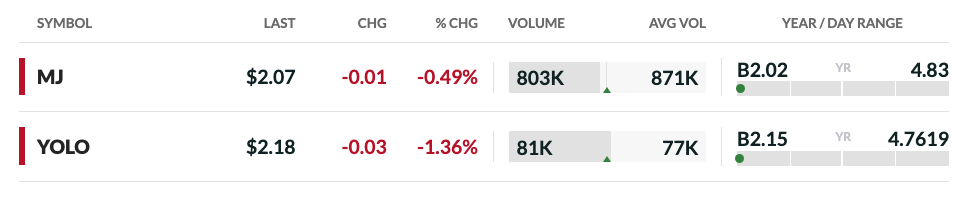

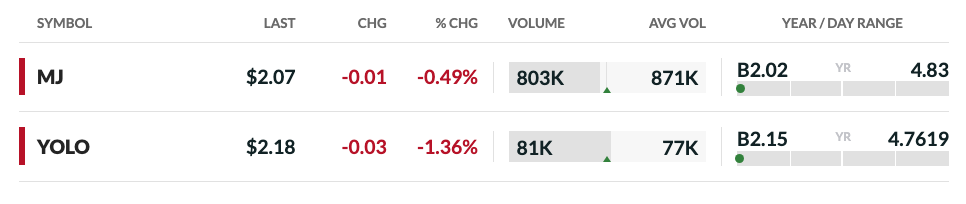

Cannabis ETFs for Investors

ETFs offer a diversified approach to investing in the cannabis sector, encompassing a range of companies involved in cultivation, distribution, and ancillary services. Here are some notable options:

- ETFMG Alternative Harvest ETF (MJ): This ETF provides exposure to a broad spectrum of global cannabis companies, including those involved in cultivation, production, and distribution.

- AdvisorShares Pure Cannabis ETF (YOLO): An actively managed ETF focusing on US and Canadian cannabis companies, it encompasses various segments of the industry.

- Global X Cannabis ETF (POTX): This ETF targets both medical and recreational cannabis firms, offering investors diversified exposure to the sector.

The Future of the Marijuana Stock Market

Looking ahead, several factors could shape the cannabis stock market—one of which concerns federal legislative changes in the US. If cannabis was legalized nationwide, this would have huge implications domestically and globally.

Another significant factor is medical advancements. If cannabis is proven to have significant medical potential, then this will greatly increase the value of pharmaceutical stocks, and probably all cannabis-related stocks. Equally, if it was proven to have insubstantial medical value, then stocks would drop.

The fate of global markets is also going to be a crucial factor. Will more countries legalize cannabis, or will prohibition rear its head again? The international legal landscape will determine the future of cannabis stocks.

Is It Worth Investing in Cannabis Stocks?

Cannabis stocks are worth investing in for those who are able to take the risk. The whole industry has the potential to blossom and become even bigger than it already is, in which case it will pump out dividends. However, due to the legal situation surrounding weed, it could also crash. On top of that, there are all of the usual risks associated with investment to bear in mind.

So if you’re up to the research and have some spare capital, it’s certainly worth investing in cannabis stocks. But if you can’t afford to lose, then there are better ways to spend your money.

Cannabis Stock Market FAQ

- What is the cannabis stock market?

- The cannabis stock market consists of publicly traded companies involved in the cultivation, distribution, and research of cannabis products. These stocks are listed on major exchanges and OTC markets.

- How does legalization impact cannabis stocks?

- Legalization boosts investor confidence, increases market size, and drives stock prices up. However, regulatory uncertainty can also cause volatility.

- What are the best cannabis stocks to invest in?

- Top stocks include Canopy Growth, Tilray Brands, Curaleaf, Green Thumb Industries, and Trulieve. Performance varies based on market conditions and regulations.

- What are the risks of investing in marijuana stocks?

- Risks include regulatory uncertainty, high volatility, financial instability of some companies, and fluctuating consumer demand.

- How can beginners start investing in cannabis?

- Beginners should research cannabis companies, choose a brokerage platform, diversify their investments, and consider ETFs for lower-risk exposure.

- Are there ETFs available for cannabis investments?

- Yes, popular cannabis ETFs include ETFMG Alternative Harvest ETF (MJ), AdvisorShares Pure Cannabis ETF (YOLO), and Global X Cannabis ETF (POTX), offering diversified exposure.

Disclaimer: The information contained in this article is for informational purposes only and should not be considered as personal investment advice or a recommendation to buy, sell or hold any financial asset.